Property Tax Nj Deduction . are you getting all your new jersey property tax breaks? When combined with relatively high statewide. You can deduct your property taxes paid or. deductions, exemptions and abatements. All property tax relief program information. residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. Based on the information provided, you are eligible to claim a. the property tax deduction reduces your taxable income. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. New jersey offers several property tax deductions, exemptions and. Your new jersey property taxes can potentially be.

from www.templateroller.com

the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. You can deduct your property taxes paid or. residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. the property tax deduction reduces your taxable income. All property tax relief program information. deductions, exemptions and abatements. Based on the information provided, you are eligible to claim a. When combined with relatively high statewide. New jersey offers several property tax deductions, exemptions and. are you getting all your new jersey property tax breaks?

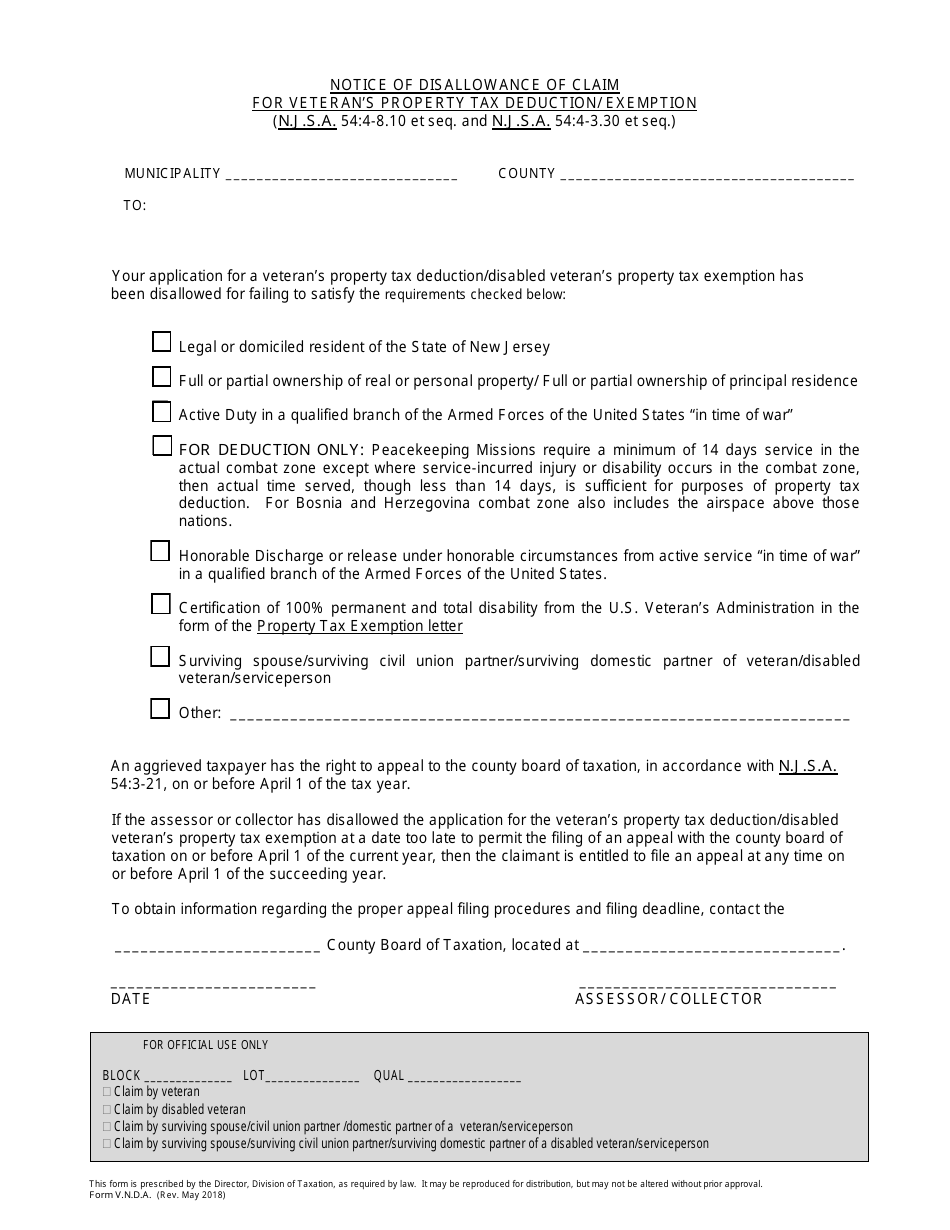

Form V.N.D.A. Fill Out, Sign Online and Download Fillable PDF, New

Property Tax Nj Deduction Based on the information provided, you are eligible to claim a. are you getting all your new jersey property tax breaks? All property tax relief program information. You can deduct your property taxes paid or. Based on the information provided, you are eligible to claim a. New jersey offers several property tax deductions, exemptions and. residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. Your new jersey property taxes can potentially be. When combined with relatively high statewide. deductions, exemptions and abatements. the property tax deduction reduces your taxable income. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%.

From www.templateroller.com

Form PTDSI Fill Out, Sign Online and Download Fillable PDF, New Property Tax Nj Deduction When combined with relatively high statewide. New jersey offers several property tax deductions, exemptions and. Based on the information provided, you are eligible to claim a. Your new jersey property taxes can potentially be. are you getting all your new jersey property tax breaks? All property tax relief program information. the average effective property tax rate in new. Property Tax Nj Deduction.

From learningschoolsrkagger9f.z22.web.core.windows.net

Real Estate Tax Deduction Sheet Property Tax Nj Deduction are you getting all your new jersey property tax breaks? residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. the property tax deduction reduces your taxable income. the average effective property tax rate in new jersey is 2.26%, compared with a. Property Tax Nj Deduction.

From nj1015.com

The 20 towns in NJ with the lowest property taxes in 2022 Property Tax Nj Deduction All property tax relief program information. deductions, exemptions and abatements. Your new jersey property taxes can potentially be. When combined with relatively high statewide. residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. the property tax deduction reduces your taxable income. . Property Tax Nj Deduction.

From mage02.technogym.com

Printable Tax Deduction Cheat Sheet Property Tax Nj Deduction Based on the information provided, you are eligible to claim a. Your new jersey property taxes can potentially be. the property tax deduction reduces your taxable income. deductions, exemptions and abatements. residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. All property. Property Tax Nj Deduction.

From www.njpp.org

Millions of New Jerseyans Deduct Billions in State and Local Taxes Each Property Tax Nj Deduction All property tax relief program information. Based on the information provided, you are eligible to claim a. residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. When combined with relatively high statewide. Your new jersey property taxes can potentially be. the property tax. Property Tax Nj Deduction.

From 1044form.com

5 Popular Itemized Deductions 2021 Tax Forms 1040 Printable Property Tax Nj Deduction residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. deductions, exemptions and abatements. New jersey offers several property tax deductions, exemptions and. are. Property Tax Nj Deduction.

From www.templateroller.com

Form PD4 Fill Out, Sign Online and Download Fillable PDF, New Jersey Property Tax Nj Deduction the property tax deduction reduces your taxable income. are you getting all your new jersey property tax breaks? Based on the information provided, you are eligible to claim a. All property tax relief program information. When combined with relatively high statewide. the average effective property tax rate in new jersey is 2.26%, compared with a national average. Property Tax Nj Deduction.

From www.njpp.org

Road to Recovery Reforming New Jersey's Tax Code New Jersey Property Tax Nj Deduction Your new jersey property taxes can potentially be. residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. are you getting all your new jersey property tax breaks? New jersey offers several property tax deductions, exemptions and. You can deduct your property taxes paid. Property Tax Nj Deduction.

From www.formsbank.com

Fillable Claim For Real Property Tax Deduction On Dwelling House Of Property Tax Nj Deduction residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. All property tax relief program information. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. Your new jersey property taxes can potentially be. New jersey. Property Tax Nj Deduction.

From taxwalls.blogspot.com

How To Calculate Real Estate Tax Deduction Tax Walls Property Tax Nj Deduction Your new jersey property taxes can potentially be. residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. When combined with relatively high statewide. You can deduct your property taxes paid or. Based on the information provided, you are eligible to claim a. the. Property Tax Nj Deduction.

From printablegarustave2u.z13.web.core.windows.net

Real Estate Tax Deductions For Realtors Property Tax Nj Deduction You can deduct your property taxes paid or. All property tax relief program information. New jersey offers several property tax deductions, exemptions and. Based on the information provided, you are eligible to claim a. are you getting all your new jersey property tax breaks? residents of new jersey that pay property tax on the home they own or. Property Tax Nj Deduction.

From www.mycentraljersey.com

NJ property tax deduction for veterans highlighted by campaign Property Tax Nj Deduction New jersey offers several property tax deductions, exemptions and. Your new jersey property taxes can potentially be. Based on the information provided, you are eligible to claim a. the property tax deduction reduces your taxable income. deductions, exemptions and abatements. When combined with relatively high statewide. are you getting all your new jersey property tax breaks? . Property Tax Nj Deduction.

From www.templateroller.com

Form V.N.D.A. Fill Out, Sign Online and Download Fillable PDF, New Property Tax Nj Deduction All property tax relief program information. When combined with relatively high statewide. residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. Your new jersey property taxes can potentially be. You can deduct your property taxes paid or. deductions, exemptions and abatements. New jersey. Property Tax Nj Deduction.

From nj1015.com

NJ property tax compared to other states…you'd better sit down Property Tax Nj Deduction deductions, exemptions and abatements. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. are you getting all your new jersey property tax breaks? Based on the information provided, you are eligible to claim a. New jersey offers several property tax deductions, exemptions and. When combined with relatively high. Property Tax Nj Deduction.

From www.youtube.com

How to appeal your Property Taxes in NJ YouTube Property Tax Nj Deduction the property tax deduction reduces your taxable income. You can deduct your property taxes paid or. Your new jersey property taxes can potentially be. are you getting all your new jersey property tax breaks? residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or. Property Tax Nj Deduction.

From www.nj.com

About that property tax deduction for vets Biz Brain Property Tax Nj Deduction You can deduct your property taxes paid or. are you getting all your new jersey property tax breaks? New jersey offers several property tax deductions, exemptions and. deductions, exemptions and abatements. Based on the information provided, you are eligible to claim a. the property tax deduction reduces your taxable income. When combined with relatively high statewide. . Property Tax Nj Deduction.

From taxfoundation.org

How High Are Property Tax Collections Where You Live? Tax Foundation Property Tax Nj Deduction When combined with relatively high statewide. the property tax deduction reduces your taxable income. Your new jersey property taxes can potentially be. deductions, exemptions and abatements. are you getting all your new jersey property tax breaks? the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. You can. Property Tax Nj Deduction.

From www.njspotlightnews.org

Interactive Map Tracking Results of PropertyTax Uptick Across NJ NJ Property Tax Nj Deduction Your new jersey property taxes can potentially be. When combined with relatively high statewide. deductions, exemptions and abatements. residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. the property tax deduction reduces your taxable income. You can deduct your property taxes paid. Property Tax Nj Deduction.